Bitcoin Price Reversal Begins, Will BTC Break $58 Hurdles?

[ad_1]

Bitcoin (BTC), the world’s biggest cryptocurrency by market cap appears to be recovering after its price hitting a monthly low of $55,500. In recent days, the BTC price has fallen by more than 10%, but over the past three days, it has jumped more than 5%, which could be considered a sign of a price reversal.

Bitcoin Price Reversal

With a recent price surge, BTC has experienced a breakout from a descending trendline and is now heading toward a strong resistance level of $58,000.

At press time, BTC has trading near the $56,740 level and has experienced a price surge of more than 4.5% in the last 24 hours. Meanwhile, traders’ and investors’ interest has skyrocketed as its trading volume has increased by 86% during the same period.

Bitcoin Technical Analysis

According to expert technical analysis, despite trading below the 200 Exponential Moving Average (EMA) in both four-hour and a daily time frame, BTC appears bullish. Additionally, the price surge occurred following the formation of a bullish divergence on its Relative Strength Index (RSI) on a daily time frame.

Based on the historical price momentum, there is a high possibility that the BTC price could soar another 10% to the $62,000 level in the coming days.

Bullish On-chain Metrics

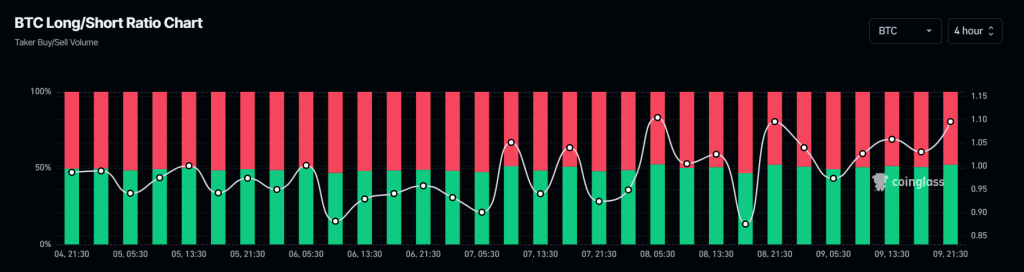

Besides this technical analysis, on-chain metrics also support this current bullish outlook. Coinglass’s BTC Long/Short ratio currently stands near 1.095, which is a bullish signal (a value above 1 indicates bullish sentiment among traders). Additionally, BTC’s future open interest has increased by 6% in the last 24 hours and continues to rise.

Traders and investors often use this combination to build long/short positions.

Key Liquidation Areas

As of now, the major liquidation areas are near $55,900 on the lower side and $57,000 on the upper side, as traders at these levels are over-leveraged, according to coinglass data.

If the current bullish market remains unchanged and the BTC price reaches to $57,000 level, nearly $71 million worth of long positions will be liquidated. Conversely, if the sentiment changes and the price drops to the $55,900 level, approximately $91.2 million worth of long positions will be liquidated.

This data suggests that now the bulls are currently dominating and have the potential to liquidate more short positions in the coming days.

[ad_2]

Source link